Purchase Order Charges

PO

charges

There

are different kind of charges which are the part of goods purchase process like

freight charges, insurance charges and installation charges. Some of the charges

increase inventory value by adding charges cost to inventory cost. In this case,

there are two scenarios which are illustrated below.

First

scenario: The charges which are payable to same vendor to whom we are

purchasing the other goods is very simple process in AX. We can create a PO, add

charges over that and after GRN on invoice the whole liability gets created

against a single vendor.

The

main reason of writing this blog is the second scenario which is stated below.

Second

scenario: The charges which are payable to another vendor but charges amount

has to be added to inventory cost. for example if an organization is buying

some goods from vendor A but he is not providing the transportation service to

move the goods from his location to customer’s location, so a transporter is

contacted to avail transportation services to load move and unload the goods

from sender to receiver and organization wants to make these charges part of

inventory value so how we do this in AX? Two separate orders can’t be generated

as the charges amount need to be added with inventory cost, In AX a PO can have

one vendor only and we have to generate the liability against two vendors for

this purchase one for transporter for the freight charges and other for Vendor

A for goods purchase.

In

below steps I am going to provide a solution for this scenario.

Setup Charges

Navigate

to Accounts payable > Charges setup > Charges code

1. Click New. In the Charges code

field, type a code for the charge.

2. In the Description

field, type a description of the charge.

3. On the Posting Fast Tab,

specify how the charge is automatically debited and credited. It is very

important to setup for this scenario

·

Debit

type = Item

·

Credit

type = Ledger Account

·

Account

(I would recommend to open a clearing

account for this scenario of expense nature)

Associate charges with purchase

order

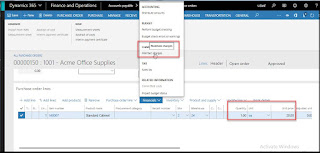

Navigate

to Procurement & Sourcing > Purchase orders > All Purchase orders.

1. Create a PO > Mention vendor

of goods purchasing (1001)

2. Create PO lines > in example

below I have selected item M007 with qty 1.00and unit price 20.00

3. To associate charges with the Purchase

order, Financials tab > Maintain charges > below Maintain charges form

will appear.

4. Select charges code that we

created above and mention charges value. Here I have provided charges value as

5.00.

5. Click Save and proceed to PO

confirmation.

Generate Goods Receiving Note

1. After Confirm PO, go to Receive

tab over purchase order form > Click On

Product receipt.

2. Enter receipt number > click

ok.

Generate Invoice

1. Go to Invoice tab over purchase

order form > Generate > Invoice.

2. Enter invoice number, date and

post invoice

Now

verify invoice voucher to see charges and PO amount has been credited

separately.

Here,

it is important to highlight that till yet we have parked charges amount in a

separate account only not in the transporter’s vendor account.

Create & Post Invoice

Journal for Transporter Liability

Now

we will generate liability for the transporter account, to do this we will

settle above clearing account with transporter’s account by creating invoice

journal.

Entry

will be

Clearing account (Expense) db

Vendor

cr

(Let’s assume ‘Air cargo Carrier vendor’ as transporter)

Navigate

to Accounts payable > Invoices > Invoice Journal

1. Create invoice journal > On

lines form > Set account = transporter vendor

2. Enter charges amount as credit.

3. Set offset account as above

clearing account which is 600120 in our example (Which got credited on PO

invoice)

4. Click Post.

Check Vendor

Balance for Transporter

Now

we will verify that liability has been generated successfully for the transporter.

Navigate

to Accounts payable> Vendors > All vendors (Select Air cargo Carrier

vendor’) > Vendor > Transactions > Balance

Pay Transporter

Now

we will pay the amount to transporter for the charges.

Navigate

to Accounts Payable > Payments > Payment Journal

5. Create new journal > On

lines > enter vendor account > click on settle transactions

6. On Settle transactions form

> select the invoice that we have created for charges through invoice

journal > Click OK

7. Provide offset account and post

payment journal.

RESULT:

After

executing this whole scenario,

Freight

charges has been paid to transporters, while goods purchasing amount has been

paid to main vendor and inventory cost has charges amount included.

Verify Inventory Cost

Navigate

to Inventory Management > Reports & Inquiries > On-hand list

Comments

Post a Comment